Tata 1mg | Acquisition Project

India's trusted online pharmacy & healthcare app

PRODUCT: Tata 1mg 💊

🧠 What is Tata 1mg?

Tata 1mg was originally launched as HealthKartPlus — a Wikipedia for medicines — in 2013 by Prashant Tandon, Gaurav Agarwal, and Vikas Chauhan. Later in April 2015, 1MG was created to make medicines and medical products more accessible and affordable to the general public. And, what we know today as Tata 1mg (~60% stake owned by Tata Digital) is a digital healthcare platform that offers a range of healthcare services to its users. Currently, the platform provides:

- An online pharmacy that delivers medicines to your doorstep.

- Home sample collection for diagnostic tests.

- Access to online consultations with doctors and specialists.

- Health tips and articles to help its users manage their health and at the same time stay informed about the latest healthcare trends.

According to Tata 1mg, the brands mission is to make healthcare accessible and affordable for everyone, regardless of their location or income.

What is the core value prop of Tata 1mg?

- ⏰ On-time Delivery of medicines

- 📝 Widest range of medicines

- 👩⚕️ Genuine medicines, trusted pharmacy

- 🩺 Your trusted diagnostic lab

PMF achieved? (Yes) ✅

According to recent media reports, Tata 1mg has become the market leader (31% market share as on Sept 2023) in India’s e-pharmacy market, thus validating its product market fit and users’ willingness to continue using the platform.

Product Metrics

(Source: Tata 1mg)

(Source: Tata 1mg)

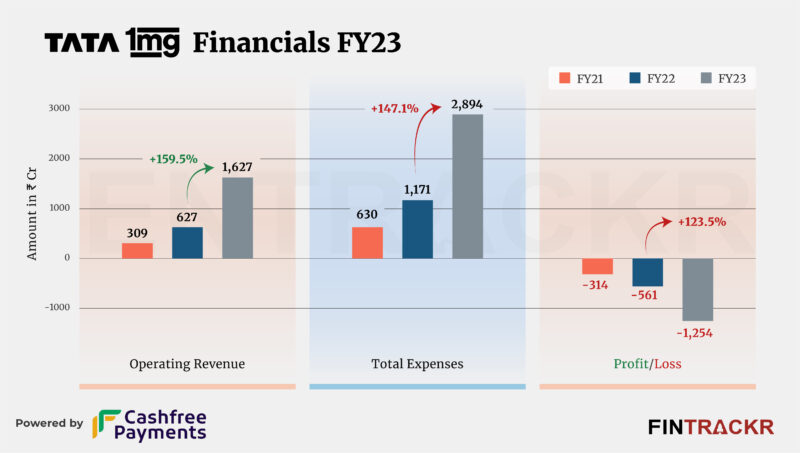

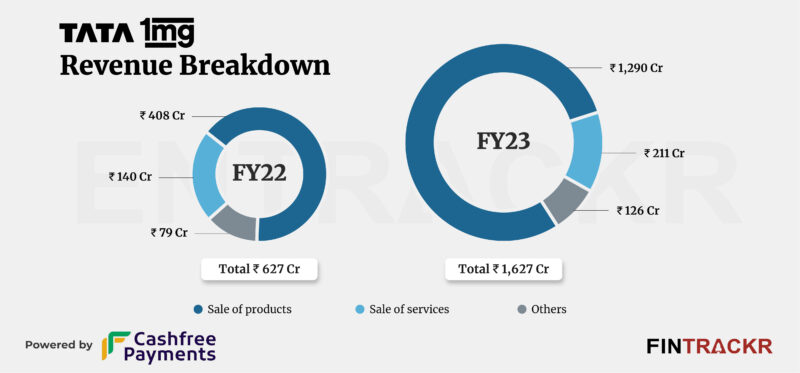

(Source: Fintracker)

(Source: Fintracker)

(Source: Fintracker)

(Source: Fintracker)

👥 ICP: The users

Based on user calls with ~10 users, the below three customer profiles have been identified:

Particulars | ICP 1 | ICP 2 | ICP 3 |

Name | Varsha | Varun | Vansh (The |

Age | 20-30 | 30-50 | 30-50 |

Gender | Female | Male | Male |

City | Bangalore | Delhi | Hyderabad |

Education | Graduate/Post-Grad | Post-Graduate | Post-Graduate |

Professional status | Entry level/mid-career | Sr Manager & above | Manager & above |

Marital Status | Single | Married | Married |

Kids | No | Yes | Yes |

Income level | 10-20 LPA | 20-50 LPA | 30-50 LPA |

Mose used apps | Instagram, Netflix, Swiggy, Amazon, Youtube, Rapido | Linkedin, Instagram, X, Amazon, Swiggy, Spotify, Youtube, Netflix, Groww, Uber | Linkedin, Instagram, X, Amazon, Zomato, Netflix, Spotify, Smallcase |

Where do you spend free time? | Friends, OTT, Travel | Family, Travel, eating out, OTT | Family, Travel, eating out, OTT, investing |

Main reason to use Tata 1mg (Convenience or Money) | Trust and savings (Money) | Availability of medicines, Lab Tests & brand trust (Convenience) | Access to trusted labs for easy scheduling of regular body-checkups (Convenience) |

Key feature/product used | Medicines | Medicines, lab test | Lab tests |

Order Frequency | Once in 2 months | 1+ times a month | Once in 3 months |

Average order value | ~ Rs.500/- | ~ Rs.2,000/- | ~ Rs 1,500/- |

Other similar solutions used | Apollo24x7, Pharmeasy, Netmeds | Apollo24x7, Pharmeasy | Orange Health, Dr Lal Path Labs |

✨ User Insights: What does the product solve for?

Most common problems/solutions gathered during user survey:

🛑 Problem 1: Medicine delivery for elderly parents living in another city.

✅ Solution 1: Users can order medicines for parents from any city they are currently living in.

🛑 Problem: Busy work schedules doesn’t allow to visit pharmacy in person.

✅ Solution: Tata 1mg app allows users to order medicines 24x7 whenever they find time (be it night, while commuting to work, etc)

🛑 Problem: Shifted to a new city and don’t know a credible pharmacy shop in the vicinity.

✅ Solution: The app gives users peace of mind by providing medicines from credible pharmacies.

🛑 Problem: Unable to find time to take all family members for health checkups or find a trusted lab in a new city.

✅ Solution: Availability of certified labs and collection of samples right from the comfort of home.

✨ ICP Prioritization

Based on above observations, Varsha (ICP1) and Varun (ICP2) have been identified for scaling acquisition efforts.

ICP | Adoption Curve | Frequency of use | Appetite to Pay | TAM | Distribution potential | Select |

ICP 1: Varsha (New in town) | Low | High | High | High | High | ✅ |

ICP 2: Varun (Family Man) | Low | High | High | High | High | ✅ |

ICP3: Sushant (Busy Professional) | Medium | Medium | High | High | High | ❌ |

👥 ICP validation

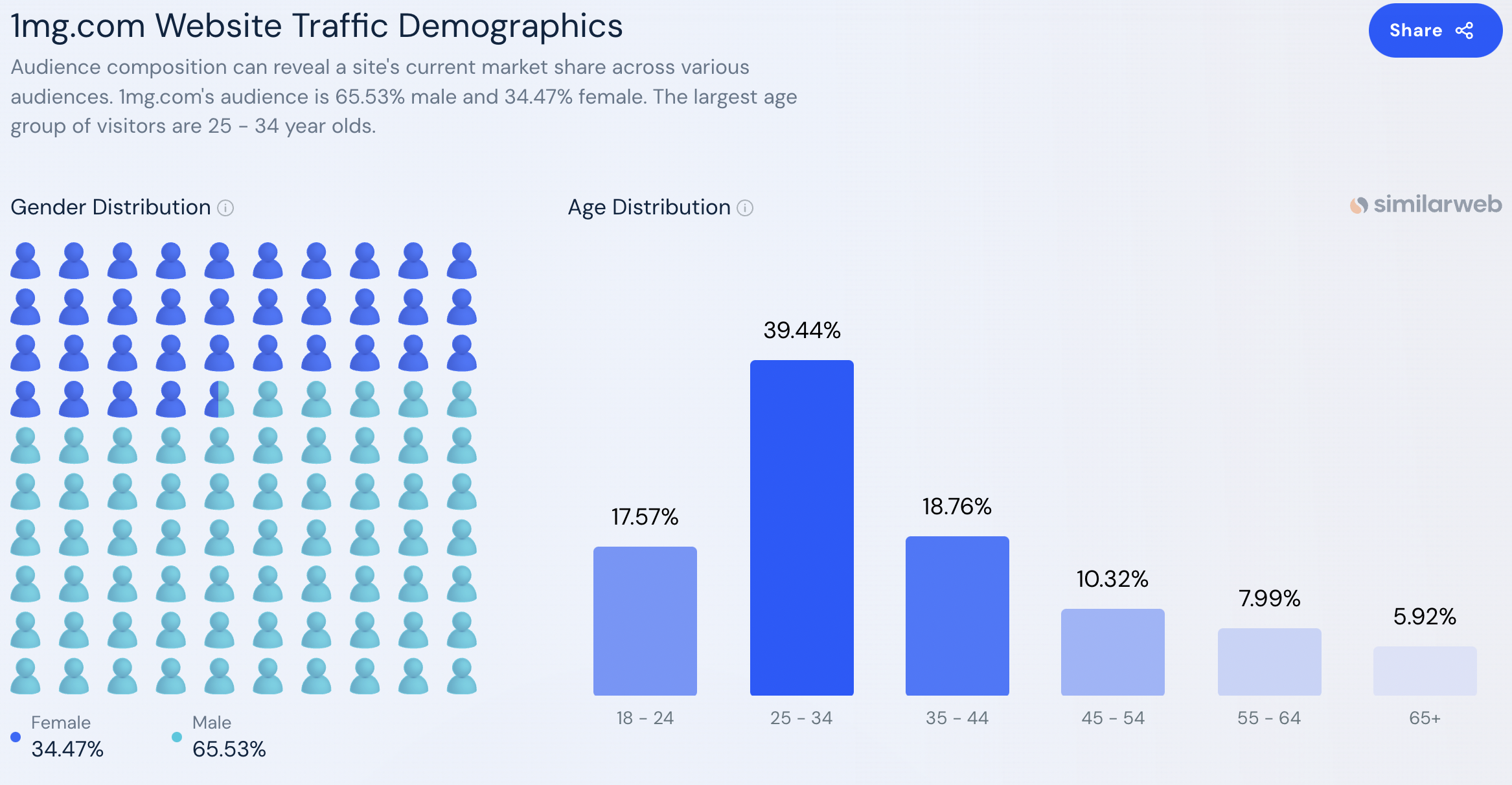

The above graphic closely validates the ICP prioritization for the acquisition framework.

The above graphic closely validates the ICP prioritization for the acquisition framework.

📊 The Market (TAM, SAM, SOM)

We are taking top down approach to calculate TAM, SAM, SOM.

Recently, as part of expansion plans, Tata 1mg has started a pilot project of around 50 offline stores across India. But, for the brevity of this project, we will be taking into consideration the digital app users of Tata 1mg.

TAM (Total Addressable Market)

- India’s total population: 1.43 Bn

- Active internet users: ~750-780 Mn

- Active smartphone users: 600 Mn+

- Digital payment users: 350 Mn+

- India’s E-Pharmacy Market: ~INR 40 Bn (@*22% CAGR)

SAM (Serviceable Addressable Market)

Even though Tata 1mg is presently serving 1800+ cities, but serving the entire TAM is impossible. So, for SAM, we are taking an assumption that the platform will be able to serve around 60% of TAM.

SOM (Serviceable Obtainable Market)

With strong competition in the market by the likes of Pharmeasy, Apollo24x7, Netmeds, Flipkart Health etc, we are assuming Tata 1mg will able to capture around 50% of SAM.

🧭 Channel Prioritization Strategy

Channel | Cost | Flexibility | Effort | Lead time | Scale | Select |

Organic | Low | Low | High | High | Medium | ❌ |

Paid Ads | High | High | High | Low | High | ❌ |

Product Integrations | Medium | Medium | Medium | Low | High | ✅ |

Referrals | Low | High | Medium | Low | High | ✅ |

Content Loops | Medium | Low | High | High | Medium | ❌ |

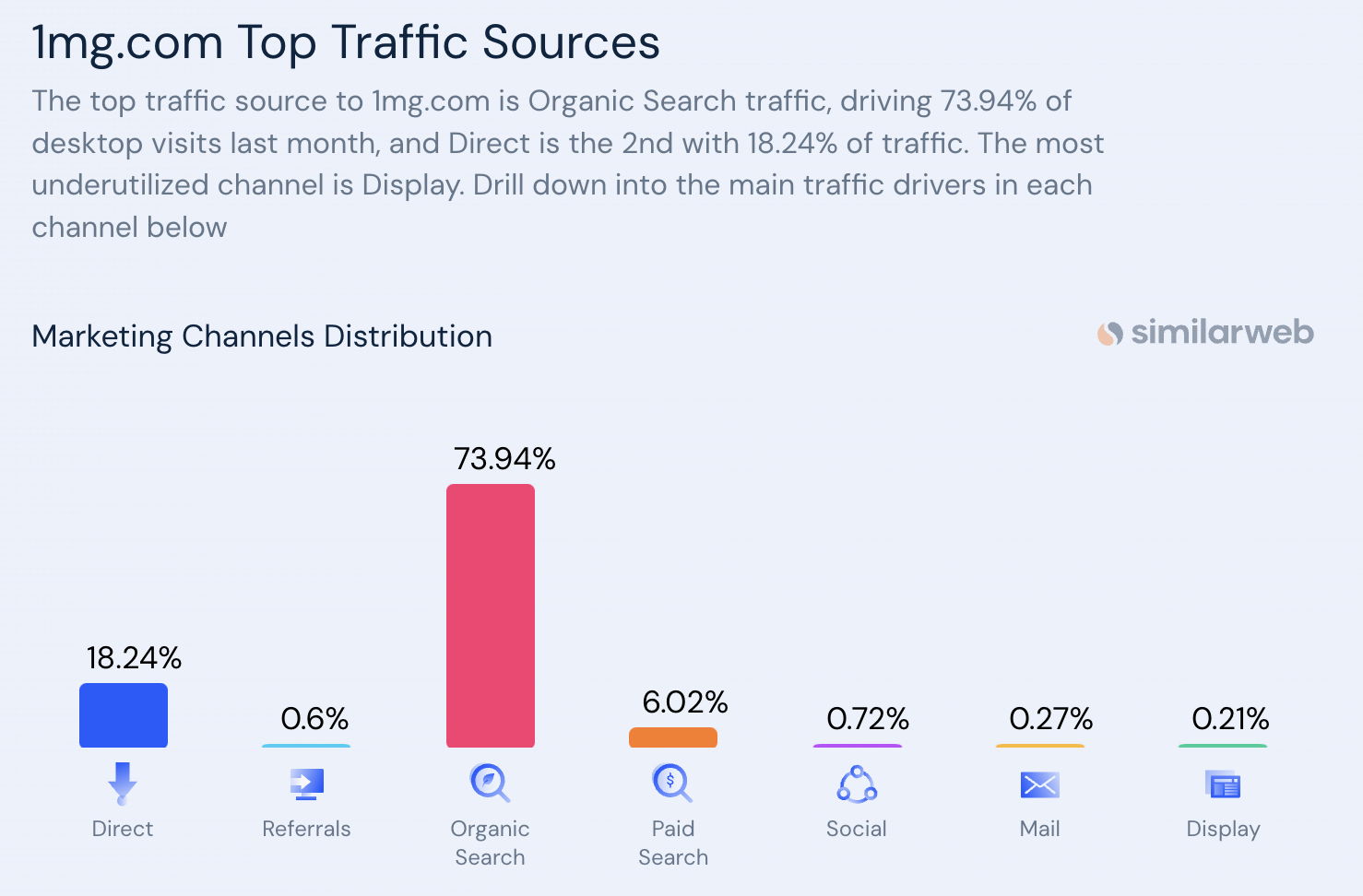

Based on above-mentioned channel prioritization framework and traffic source data, we see Organic Search as the topmost traffic driver for acquisition and Direct being a close second (this means Tata 1mg enjoys a fairly good brand recall).

Since these two channels already contribute close to 93% of present traffic, I suggest exploring Referrals and Product Integration for scaling acquisition of new users as they are likely to have high impact in the long term.

Channel 1: Referral

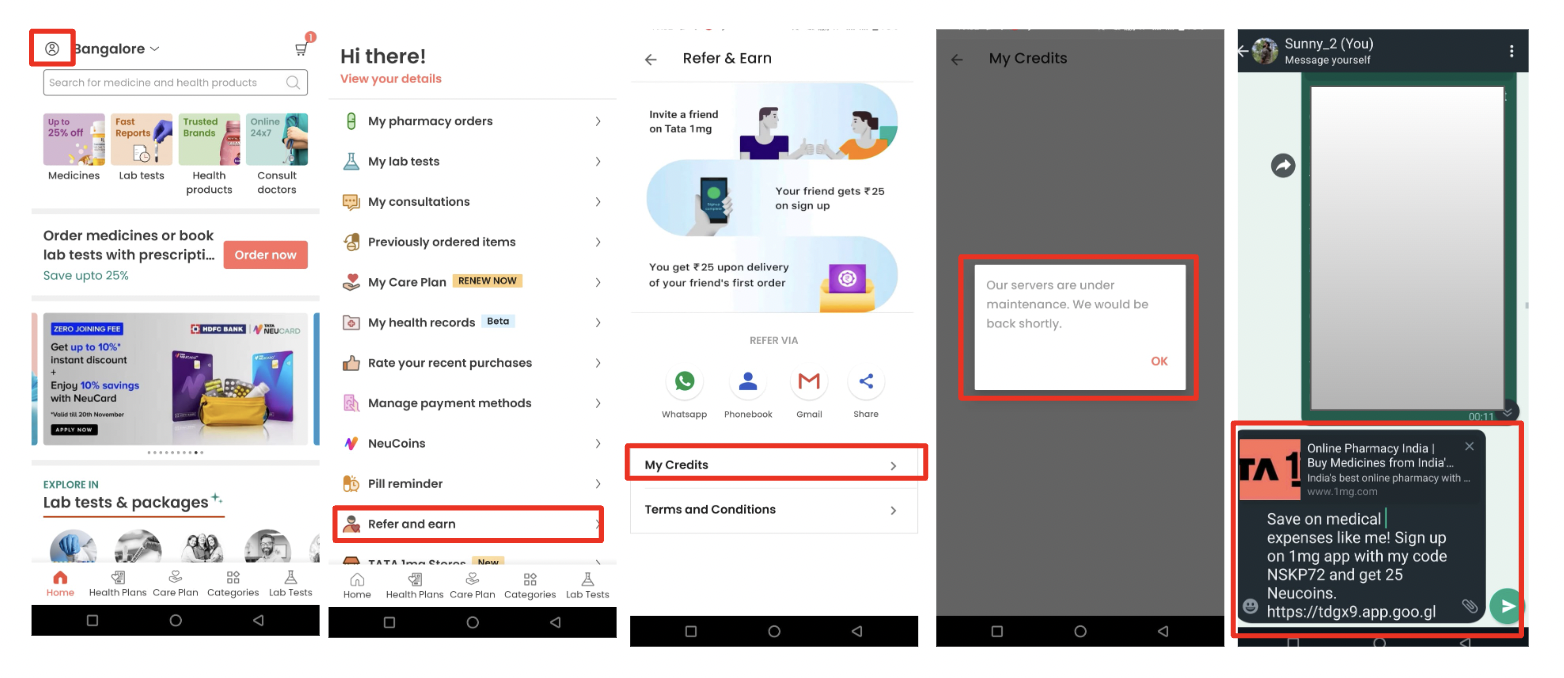

📲 Current flow for a referrer (navigation clicks highlighted in red):

✅ What works?

- A referral option exists

- Clear communication on why they should refer (the platform currency & motivation being cashback of Rs 25 for both referrer and referee)

- Option to customise the whatsapp copy (which is also the first option to share a referral)

❌ What doesn't work?

- Based on user feedback, only 10% users have referred the app. The main reason being difficulty in discovery of referral option.

- "My Credits" page appears to be broken (always showing a server error).

- Currently, the only referral option visibility is inside a user's profile (user flow attached above)

- The option is not available anywhere in a user's journey, not on homepage or on past orders page.

📝 Suggestions:

Since the users have a lot of trust on the brand (validated during user calls), referral as a channel has a very high potential to bring in quality users. Below are some suggestions to improve referral as a medium:

- There should be an option to rate order delivery experience, which could be a good placeholder to add referral option.

- At present, there are little to no notification nudges sent to users for referrals. This should be experimented initially with low frequency to see how it impacts, and then gradually scaled.

- Inclusion of an option to share a particular sku item page (medicine, lab test, etc) with anyone via any social media option. Currently, there is no such option.

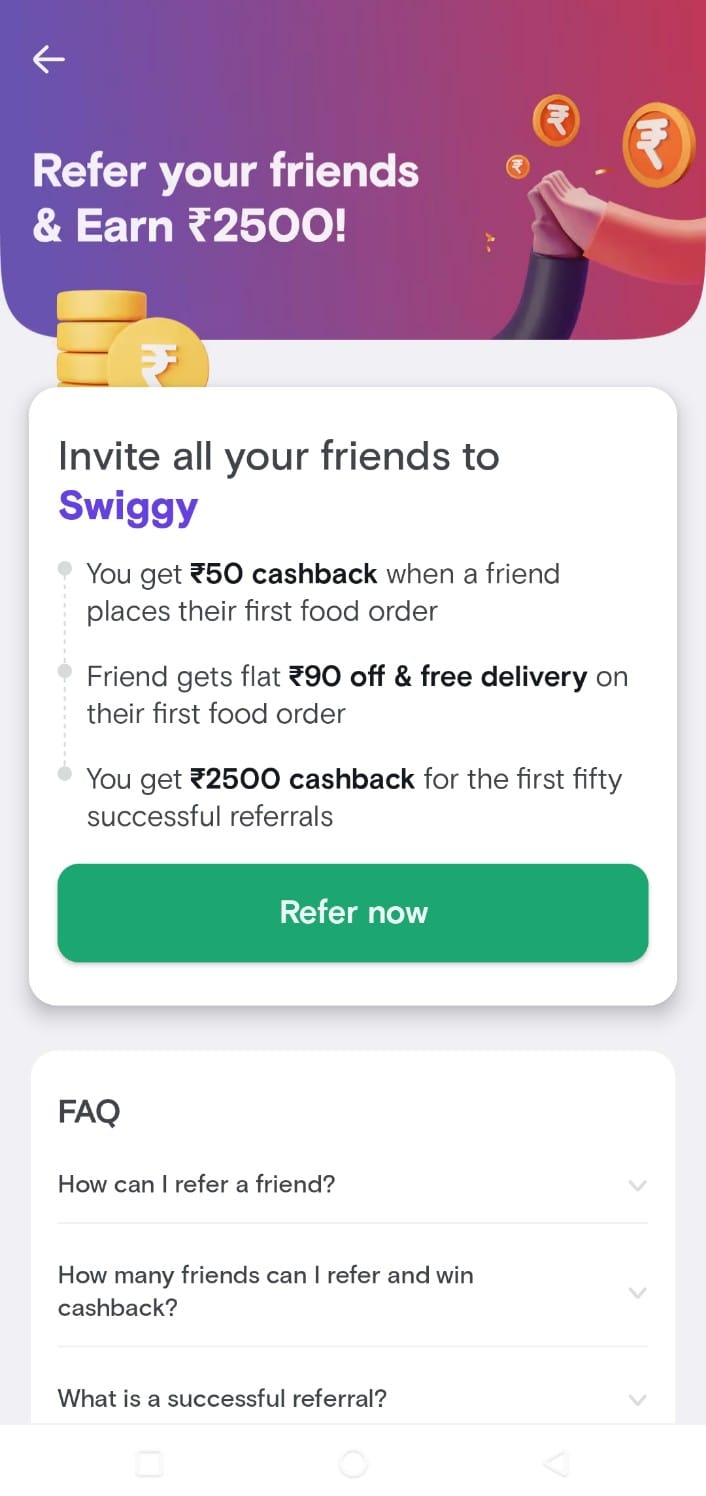

- Page 4 of the referral journey (Referral credit status) appears to be a broken page. Even if a user hasn't referred anyone, it can be used as an opportunity to nudge them to refer. It can also be used to share more details of T&C.. For reference, Swiggy's referral page (attached below)

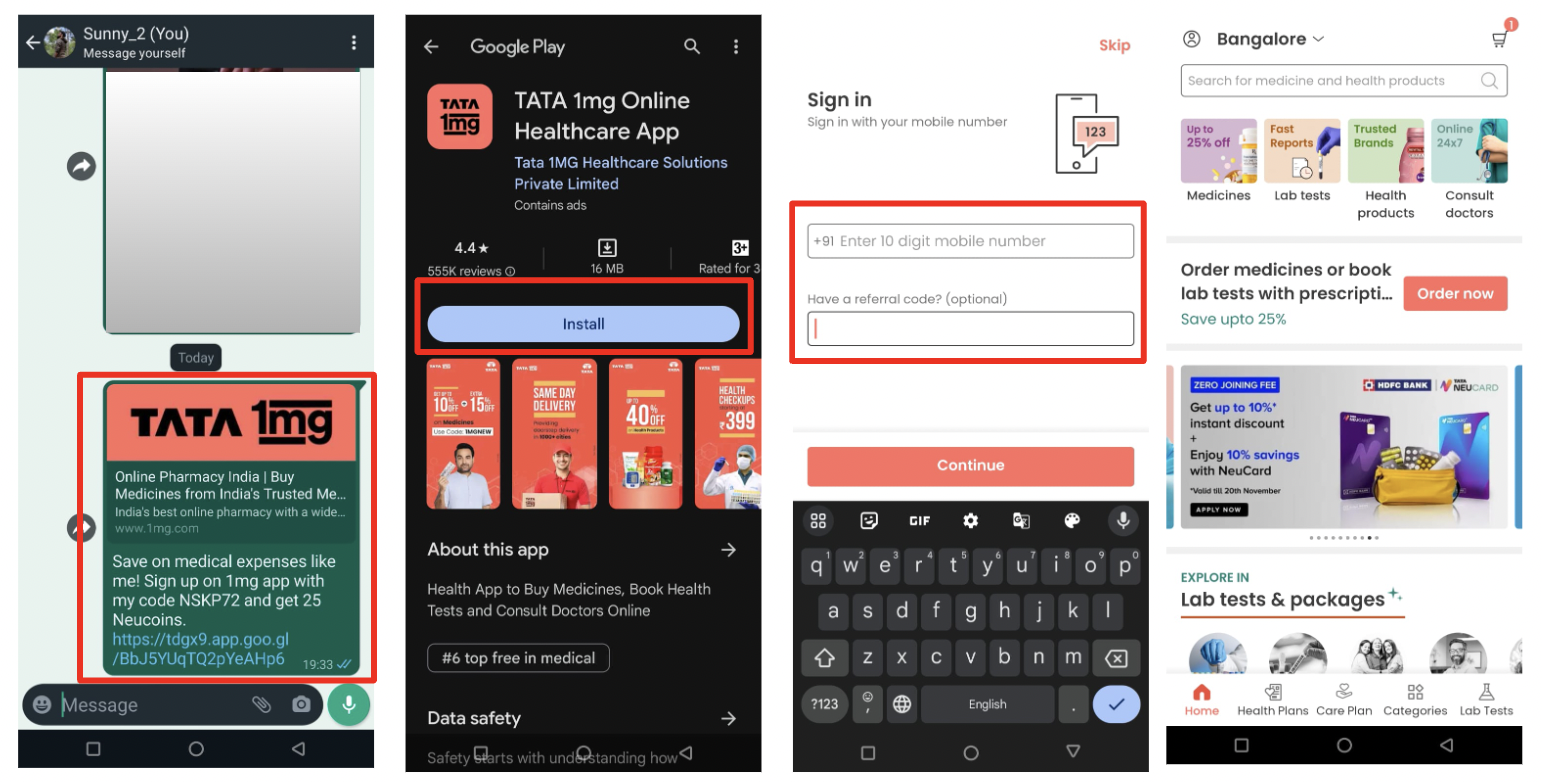

📲 Current flow for a referee (navigation clicks highlighted in red):

✅ What works?

- The whatsapp link takes users to playstore's app install page.

- High playstore ratings and reviews adds up as a social proof for new users.

- Less steps to onboard a new user.

- Core products offering mentioned on the first page load of the app.

❌ What doesn't work?

- Even though the referral code is mentioned in the referral text, after app download using the link, it is not auto fetched. This is a missed opportunity. Manually adding referral code creates friction.

- It is observed, if a user already has the app installed on the phone, the code gets auto fetched, but this defies the whole purpose of a referral.

- Although, there is a skip CTA on the top-right of page 3 of the user flow, in case of a referral this option shouldn't be there.

📝 Suggestions:

- Referral code should be auto-fetched when a first-time user lands on the app with a referral link.

- A success screen to show referral credits being added to a user's account. This will help also have a dopamine affect on a new user and prompt them to refer more users.

Channel 2: Product Integration

1. Tata 1mg 🤝 HDFC PayZapp

Since Tata 1mg and HDFC Bank already have an existing relationship in the form of branded credit card, Tata 1mg can explore product integration with HDFC's PayZapp app. This will open up HDFC's huge existing user base for acquisition by Tata 1mg.

The HDFC PayZapp currently has in-app integrations wherein the bank's customers are offered discounts on services such as flight, train & bus tickets, hotel bookings, flipkart, Apple stores, etc. All of this right inside the HDFC PayZapp app.

Once inside the HDFC PayZapp app, when a user clicks on a brand's logo, the said brand's landing page opens right inside the app, allowing them to make purchases and make payment via HDFC credit/debit cards. Since all this is happening inside the HDFC PayZapp app, other than the first page of PayZapp, there is no change in a user's sign-up and order journey. This creates a no-friction and smooth user acquisition journey. This integration could be a win-win for both HDFC and Tata 1mg.

Note: Due to app limitations, as HDFC PayZapp does't allows screenshots or video recording, attaching the landing page of the app sourced from their website.

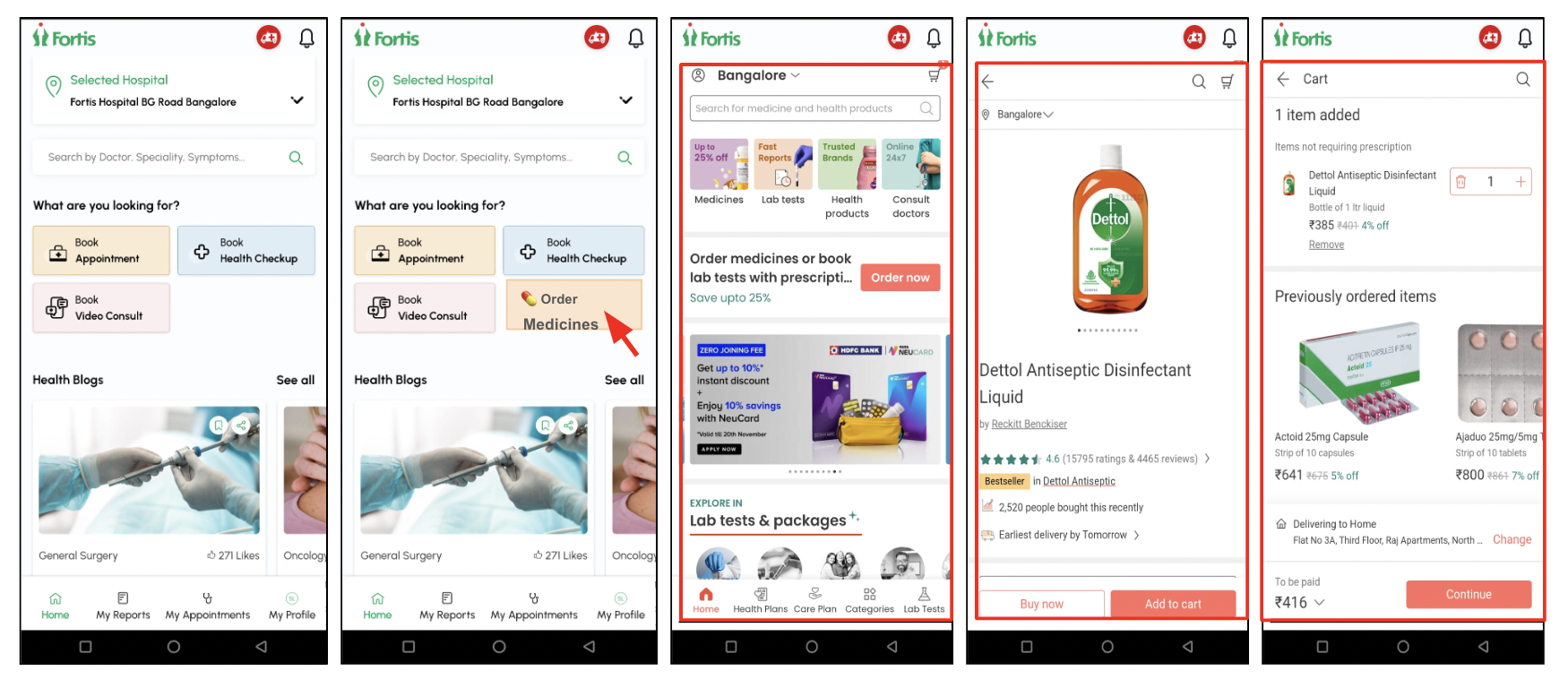

2. Tata 1mg 🤝 Fortis Hospitals

Hospitals and pharmacies are by default a perfect match!!

Since most of the patients visiting doctors require medicines (if the situation requires and doctor prescribes), an option to order medicines right inside the Fortis Healthcare app via Tata 1mg could be a relevant integration. Also, everyone visiting a hospital is by default Tata 1mg's core ICP, so this presents a very high use case.

Suggested User journey 👇

👉 Page 1: Existing page 1 of Fortis Hospital app.

👉 Page 2: Suggested integration of Tata 1mg, wherein patients can order medicines right inside the Fortis Healthcare app. (highlighted by an arrow)

👉 Page 3: Once the user clicks on the CTA <order medicines>, Tata 1mg would open right inside the Fortis Healthcare app. And, rest of the journey will be same for any Tata 1mg user.

Since patients details such as name, age, address, doctor's prescription are already uploaded on the Fortis app, they don't have to input them again. And, this really simplifies a user's journey to order medicines. The app can be made to auto fetch the medicines prescribed during a recent doctor visit and, a user would just have to select/deselect them before placing the final order.

Once successful, Tata 1mg can explore similar such integrations with other leading hospital chains who have presence across the country.

~ fin ~

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.